Everyone is familiar with semiconductor IP, that is, the proven and reusable chip design module is the upstream core technology of the chip industry just like EDA. IP development and multiplexing technology has greatly promoted the rapid development of the chip design industry.

From the perspective of market value, the current global semiconductor IP market size is about 5 billion US dollars, but it leverages the continuous evolution of the 600 billion US dollar semiconductor industry and enables the continuous development of the 1.4 trillion electronic information manufacturing industry.

It can be seen that the value and role of semiconductor IP are extremely important. It is no exaggeration to say that in the pyramid of the global semiconductor industry, IP is at the top of the value chain.

Interface IP is expected to reach the top?

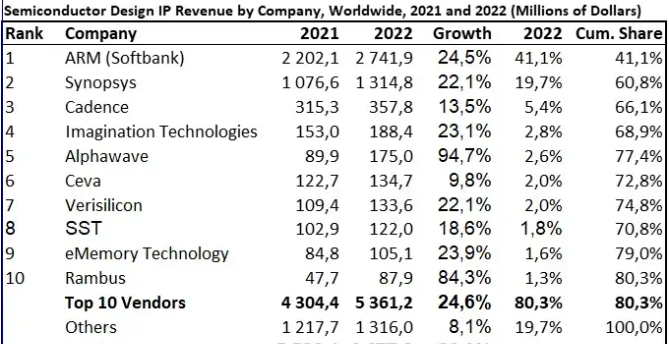

Recently, IPnest, a semiconductor IP research organization, released the “Design IP Report”. The report shows that the design IP market will reach US$6.67 billion in 2022, a year-on-year increase of 20.2%. In contrast, the growth rate in 2021 will be 19.4%, and the growth rate in 2020 will be 16.7%. The growth rate of the semiconductor IP market will continue to increase.

IPnest predicts that the semiconductor IP market size will exceed US$10 billion by 2025, with a compound annual growth rate of 16.7% from 2021 to 2026.

Judging from the Top 10 list, for most IP suppliers, the main trend of design IP in 2022 is very positive. Among them, the growth rate of Synopsys, Alphawave and Rambus in 2022 once again confirmed the market tension of the wired interface IP category (up 26.8%).

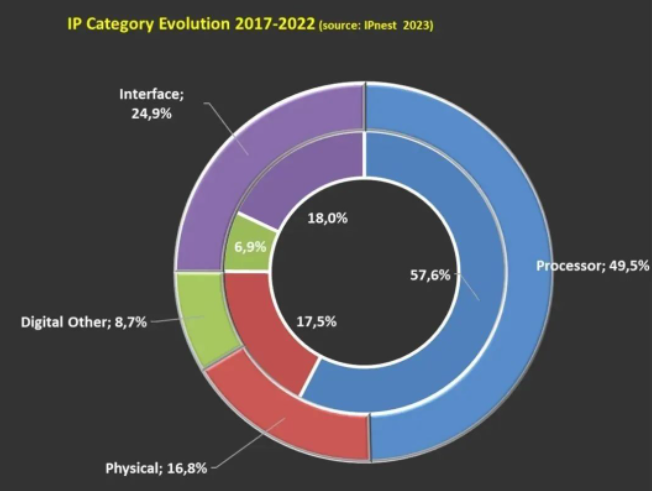

From the perspective of IP categories, from 2017 to 2022, the market share of interface IP increased from 18% to 24.9%; while the compound annual growth rate of processor IP such as CPU, GPU and DSP dropped from 57.6% to 49.5%; The two categories, IP and digital IP, remained almost unchanged.

It can be understood that the importance of interface IP is increasing day by day, and it is robbing the market share of processor IP, becoming the most promising IP category.

Over the past decade or so, smartphones have been a powerful driving force for the advancement of the IP industry. During this process, processor IP has benefited the most and has rapidly grown into the world’s largest IP category.

In recent years, with the vigorous development of the HPC market represented by data and the rise of heterogeneous computing, the demand for connections between various components has become increasingly urgent. Traditional methods and technologies have been difficult to meet the requirements of such a large number of high-speed connections . With more demand for DDR memory controllers (DDR5, LPDDR5, HBM), PCIe, CXL, and Ethernet/SerDes, wired interface IP has become a new growth engine and has now become the second largest IP category in the market.

According to IPnest’s forecast, the market share of interface IP is expected to exceed that of CPU in 2025, becoming the number one IP category.

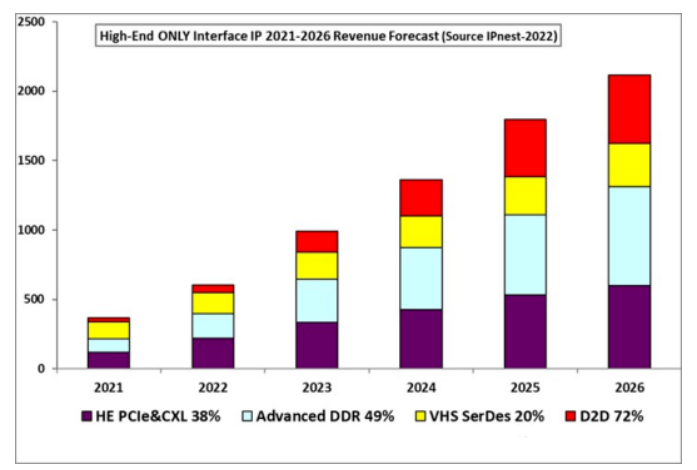

From the perspective of specific classification, interface IP is divided into wired interface IP and wireless interface IP. Wired interface IP includes USB, PCIe, DDR, SATA, D2D, etc., and USB, DDR, PCIe, MIPI and Ethernet IP are more widely used; Wireless interface IP mainly includes Bluetooth, Zigbee, Thread, etc. In the future, the increase in the interface IP market will mainly come from PCIe IP, DDR IP, Ethernet, SerDes, D2D, etc., which are highly related to data centers.

According to statistics, the four types of interface IP, PCIe, DDR, Ethernet and D2D, are expected to grow at a compound annual growth rate of 27% during 2022-2026. If only high-end interfaces are considered, the global compound annual growth rate of these four major interface IPs will reach 75% from 2021 to 2026.

Top 4 Interface IP by Revenue, 2021-2026

In addition to the above-mentioned driving factors, the recent hot large models and AIGC are also generating market demand for interface IP. For example, the training of large models requires a large number of GPUs. According to reports, the training of ChatGPT uses 10,000 high-end GPUs from Nvidia. These large numbers of GPUs need to be clustered together for training.

At the same time, the exponential growth of the amount of data faced by AI training and reasoning makes data transmission generally present the technical requirements of high bandwidth and low latency, regardless of whether there are multiple GPUs in a single server, C2C communication between CPUs, or networking between multiple servers. , which will have higher requirements for IO throughput, which will have many impacts on high-speed interface IP:

-Accelerate product iterations and improve the performance requirements of IO interfaces

-Broaden the scope of demand for IO interfaces

-Computing chip manufacturers have increased demand for interface IP customization to improve the performance of their own chips

On the other hand, as the Chiplet market heats up, the chip is divided into different small chips and interconnected, which further promotes the new demand of the related interface IP market, especially in the layout of the D2D interface of the Chiplet. According to data, although the development time of chiplet interconnection interface IP is relatively short, its growth rate is rapid. It is estimated that from 2021 to 2026, the compound annual growth rate will reach as high as 50%. By 2026, the global output value will reach 320 million US dollars.

On the whole, interface IP is ushering in rapid development driven by many market applications. IPnest predicts that the market size of interface IP will reach USD 3 billion in 2026.

Given the technological gap, what are the opportunities for domestic interface IP manufacturers?

As mentioned above, the compound annual growth rate of the semiconductor IP market in 2021-2026 is 16.7%, while the growth rate of the Chinese market is even higher. Although the interface IP market has broad prospects and rapid growth, the self-sufficiency rate of the Chinese market is less than 10%. The main market is occupied by IP manufacturers such as Synopsys, Alphawave, and Rambus.

Industry insiders told the author that various domestic interface standards still follow the international mainstream international protocols. Synopsys, Alphawave, Rambus and other manufacturers rely on their first-mover advantages and their dominant positions in their respective interfaces, and have a huge influence on the establishment and improvement of standards.

It is understood that Synopsys has a 55.6% share in the high-performance SerDes market, and this type of IP is an important pillar of the wired high-speed interconnection market. Synopsys supports almost all protocols (USB, PCIe, Ethernet, SATA, HDMI, MIPI, DDR memory controllers, etc.), and has a leading position in each protocol IP market.

Alphawave, founded in 2017, has already ranked fourth in the IP field, showing the importance of high-performance SerDes IP for the current market driven by data center applications. Currently, Alphawave is an important supplier of PAM4 112G SerDes IP required by top foundries such as TSMC, Samsung and Intel IFS for 7nm, 5nm and 3nm.

Of particular concern is that the 3nm process platform is critical to the development of a new generation of high-performance chips that need to cope with the exponential growth of AI-generated data and achieve higher performance, enhanced memory and I/O bandwidth, and reduced power consumption . This is also the SerDes with the highest performance in the current Alphawave product portfolio, and will pave the way for the development of future high-performance AI systems on the 3nm process. At the recent TSMC North America Symposium in Santa Clara, California, Alphawave will conduct the industry’s first live demonstration of a silicon platform based on TSMC’s 3nm process with 112G Ethernet and PCIe 6.0 IP.

There is a point of view that Alphawave appeared in the right place at the right time, coupled with the long-term experience of the company’s team in SerDes design, it has achieved such a performance.

Rambus provides a series of solutions for the development demands of data centers, including industry-leading memory interface chips; industry-leading HBM and GDDR6 memory subsystem IP solutions; supporting PCIe 6.0/5.0, CXL 3.0/2.0 interface subsystem IP solutions; and support the encryption of static data and dynamic data in data centers and servers to achieve hardware-level security IP solutions. These products and solutions greatly help the application needs of data centers, such as enterprise-level memory sticks, AI acceleration chips, smart network cards, network switches, memory expansion and pooling, etc.

For high-performance SerDes IP, Marvell has also successfully demonstrated its advanced semiconductor interconnect technology on the 3nm node, implementing its 122G XSR SerDes, Long Reach SerDes, PICe Gen 6 SerDes and 240 Tbps parallel chips on TSMC’s 3nm node to the chip interconnect.

In fact, as early as 2020, Marvell released the industry’s first 112G 5nm SerDes for data centers. This achievement at the 3nm node is part of its efforts to develop high-performance chip-to-chip interconnects for future computing infrastructure. According to Marvell, moving to the 3nm node will help the company unlock lower power and higher performance interconnects for applications such as chiplets, custom ASICs, Ethernet physical layer devices and more.

Regarding the advanced layout and advantages of overseas IP manufacturers in interface IP, a domestic IP manufacturer told the author that the reason why these major semiconductor IP manufacturers can obtain market advantages stems from their need to keep up with the world’s most advanced design needs, and can follow The process evolution of international leading chip design and manufacturing companies often does not fully compete under the advanced process, and chip collaborative verification and large-scale mass production experience further form barriers.

In addition, mergers and acquisitions are also the core elements for overseas manufacturers to enhance their competitiveness. Take Alphawave as an example. After starting with Serdes, it has continuously expanded its product line by acquiring a series of companies such as Openfive and Banias Lab. At present, it has completed the full coverage of IP required by data center chip companies such as Serdes, PCIe/CXL, D2D, HBM3, LPDDR4X/5, and its development speed and experience are worth learning from domestic colleagues.

Therefore, in the face of the rapid expansion of the interface IP market and the stimulation of the external environment, the trend of domestic substitution has struck, and a number of new domestic forces have emerged.

Throughout the domestic market, the number of interface-related IP design companies is growing rapidly, and the coverage of local IP types is gradually complete. With the rapid growth of the number of newly opened IC projects, many applications have a great demand for interface IP, and the number of local design companies brave to “eat crabs” is gradually increasing. However, domestic manufacturers still face the monopoly of international manufacturers and local companies in interface IP. The challenge of homogeneous competition gradually emerging.

On the one hand, domestic high-speed interface IP solution suppliers are still in a catch-up position in terms of manufacturing process and investment; on the other hand, breaking the domestic IP market is extremely challenging in design and lacks opportunities for continuous iteration.

In addition, the domestic interface IP still faces the problems of lack of talents and insufficient design experience. Designing interface IP is a multi-disciplinary comprehensive consideration point, and requires a strong process of business accumulation. At the same time, on the high-speed interface, the relevant EDA tools are relatively poor.

Although the domestic IP industry has made good progress, facing the grim situation that foreign manufacturers dominate 90% of the market share, domestic manufacturers still need to continue to invest in breaking through, and need to further calm down and focus on high-end, especially high-speed Research and development of interface IP.

Because interface IP is the underlying core technology of semiconductors, the threshold is quite high. Only through long-term technology accumulation and continuous innovation of enterprises can IP products with higher performance and lower power consumption be polished; in addition, the rapid evolution of various high-speed bus protocol standards The continuous upgrading of semiconductor technology and semiconductor technology has also brought a lot of challenges to the development of IP products. IP companies need to closely follow the manufacturing technology of chip manufacturers and foundries, and quickly launch new IP products that meet market demand.

In addition to the above aspects, domestic IP manufacturers are backed by a huge local market, and can narrow the gap through customized services and technical support advantages. For some products with a relatively long life cycle, product performance requirements do not need to keep up with the development of chip technology. Make efforts in the field of friendliness.

Secondly, facing the advantages of the brand and technology endorsement of major international manufacturers, customers are more inclined to cooperate with major manufacturers to ensure the success of one-time tape-out. Domestic IP companies can focus on the construction and improvement of brand image in emerging application fields. Finally, in terms of service quality, focus on improving the service quality in after-sales service and technical support to improve customer satisfaction and loyalty.

In the final analysis, domestic interface IP manufacturers still need to continuously polish product performance, carry out technological innovation, and at the same time find differentiated positioning and advantages, shorten the gap with industry giants, and enhance the hard power of the local IP industry.

In the macro world, the Internet of Everything has become the consensus of the global IT industry. At the integrated circuit level, a microscopic “Internet of Everything” world is taking shape. The development of heterogeneous integration, Chiplet, advanced packaging and various new applications has made chips The number of components continues to increase, and the connection requirements between various components are becoming more and more urgent. Traditional methods and technologies have been difficult to meet the requirements of such a large number and such high-speed connections.

This trend provides more development opportunities for semiconductor IP manufacturers, among which interface IP has become the top priority.

In this fast-growing market, who can see the development direction and seize the opportunity, as long as they find the right breakthrough, they are expected to achieve rapid development in a relatively short period of time, just like the aforementioned Alphawave is to seize the data During the window of opportunity for the development of central SerDes, the market share has reached the top four levels in the industry within a short period of time.

For domestic IP manufacturers, this is also an opportunity.

Post time: May-12-2023